Responding to Climate Change

The Company has positioned efforts to address climate change as one of our key issues, and the Sustainability Promotion Committee is playing a central role in identifying climate change-related risks and opportunities, assessing their impact on the Company, and considering specific measures to deal with them. The necessary data are being collected and analyzed, and the content thereof are being disclosed in accordance with the information disclosure framework recommended by the Task Force on Climate-related Financial Disclosures (TCFD)*.

In disclosing information in accordance with the TCFD recommendations, we refer primarily to the following scenarios:

・Transition Risk and Opportunities "1.5℃": International Energy Agency (IEA) WEO2020 NZE

・Physical Risks and Opportunities "4 ℃ scenario": Intergovernmental Panel on Climate Change (IPCC) AR5

*TCFD: Task Force on Climate-related Financial Disclosures; The Group expressed its endorsement of the TCFD recommendations on June 6, 2023.

| Governance | Organization's governance around climate-related risks and opportunities |

| Strategy | The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning |

| Risk Management | The processes used by the organization to identify, assess, and manage climate-related risks |

| Metrics and Targets | Metrics and targets used to assess and manage relevant climate-related risks and opportunities |

1. Governance

We recognize climate-related action as one of our key managerial priorities. For this action, we have a corporate governance system in place with the Sustainability Promotion Committee playing a central role, subject to supervision by the Board of Directors.

<Divisions and Departments Responsible for Climate Action>

The Corporate Strategy Division serves as the secretariat for the Sustainability Promotion Committee. It also serves as a liaison among the divisions and departments concerned and promotes company-wide climate action. Additionally, the Division thrashes out our sustainability strategy, which covers, among other things, matters related to climate change, and advises the Sustainability Promotion Committee.

2. Strategy

The Group recognizes sustainability action, including climate action, as one of our key managerial priorities. Supply-chain disruptions and reduced capacities to supply drugs due to intensifying natural disasters pose a significant business risk for us – an entity responsible for the distribution of vital and other drugs. They also pose a risk for society at large. Due to the nature of the business, the emission volume of the Group is characterized by low Scopes 1 and 2 emissions (emissions released directly from it) and high Scope 3 emissions (emissions released from its supply chains). With this understanding, we have conducted a scenario analysis to assess climate impacts on our business and devise measures to cope with them.

For this analysis, the Group referred to scenarios in the IPCC Fifth Assessment Report and IEA WEO2020 NZE, among others. It then considered both a 1.5 ℃ scenario – in which the global temperature rise will be limited to 1.5 ℃ by 2030 (transition scenario) – and a 4 ℃ scenario – in which the global temperature will rise 4 ℃ by 2050 (physical scenario). This analysis covers the pharmaceutical wholesaling business.

◆Global Outlooks We Assume under the 1.5 ℃ and 4 ℃ Scenarios

| Global outlook | Environmental regulations and technological advances reduce carbon emissions, thereby keeping greenhouse gas (GHG) emissions in check. Environmental regulations means the need to facilitate more use of non-fossil energy. |

| Policy/Legal | • Stricter laws and regulations |

| Fossil energy use | • Minimum use |

| Non-fossil energy use | • Aggressive deployment |

| Regulations/Institution | • The introduction of carbon taxes increases the tax burden with regard to carbon emissions (CO2 emissions) • Increasing electricity bills due to promotion of more use of renewable energy sources (renewables) • Energy efficiency subsidies (various support measures) are available • Rapid emissions reduction is required toward carbon neutrality by 2050 |

| Market | • Naphtha prices go up owing to lower gasoline demand • Promotion of energy saving reduces the use of fossil-derived energy • Expedited introduction of EVs and other low-carbon delivery means • The addition of carbon taxes and the cost of procuring renewables pushes up the cost of goods • Changes to the power mix and the impact of carbon prices increase the unit price of electricity • The impact of carbon prices and soaring prices of fossil-derived energy increase delivery costs |

| Technology | • Emergence of decarbonization technologies • Rise of non-fossil materials |

| Reputation | • Cooperation with local communities in disaster response becomes more important • ESG investment takes root • More requests from stakeholders to reduce GHG emissions • ESG compliance is an additional criterion for selecting business partners |

| Global outlook | No new policies or regulations for curbing temperature rises are implemented or encouraged, resulting in high greenhouse gas (GHG) emissions. This in turn leads to more natural disasters, thereby making it necessary to defray the costs of capital investment aimed at strengthening disaster prevention capabilities. |

| Policy/Legal | • Existing laws and regulations remain unchanged |

| Fossil energy use | • Remain unchanged |

| Non-fossil energy use | • Remain unchanged |

| Acute | • An increased intensity of extreme weather events (torrential rains, typhoons, high tides, floods, wild fires) • Rising temperatures increase the burden on air conditioners (power consumption) • Changes to the power mix push up electricity prices • Little progress in renewable deployment sends gasoline prices higher • Storms and floods disrupt transport networks |

| Chronic | • Rising mean temperatures • Rising average sea level • Depletion of water resources due to droughts • Short supply of nature-derived materials due to changing climate conditions • Increased infection due to environmental changes • More difficulty in handling products that need temperature control such as prescription pharmaceuticals |

◆Identification of Risks and Opportunities

The table below summarizes possible climate-induced events in light of the analyzed scenario by identifying risks and opportunities with high impact and evaluating the influence on business and financials from both quantitative and qualitative aspects. The Sustainability Promotion Committee will conduct a quantitative assessment, including financial impact, while considering the resilience of our strategy and the necessity to develop a transition plan.

| Category | Classification | Risks | Financial Impact (*1) | Method of calculating impact | Time frames (*2) |

|

| FY2030 | FY2050 | |||||

| Transition (1.5℃ scenario) |

Carbon tax | Increases in distribution and operational costs at stores, sales offices, logistics centers, etc., due to the introduction of a carbon tax. (The impact of a carbon tax on the supplier's purchase cost is not taken into account, since the cost is related to the drug pricing system) |

Medium (About 0.6 B yen) |

Large (About 1.1 B yen) |

Calculated based on FY 2023 CO2 emissions and IEA emission factors |

Medium to long term |

| Energy | Increase in business operating costs such as storage and

distribution of pharmaceuticals at stores, sales offices, Logistics centers, etc. due to rising energy prices. |

Large (About 1.3 B yen) |

Large (About 1.1 B yen) |

Calculated based on energy consumption in fiscal 2023 and IEA emission factors |

Medium to long term |

|

| Increase in procurement costs due to increased procurement costs at suppliers being passed on to procurement prices. |

Large※ | Large※ | ー | Medium to long term |

||

| Technology | Increase in capital investment costs due to the strengthening

of decarbonization-related policies, laws and regulations, energy conservation measures, and the introduction of decarbonization equipment. |

Large | Large | Calculated from investment in energy conservation |

Medium to long term |

|

| Reputation | Decline in stakeholder evaluation and impact on stock price

and business performance due to delay in climate change measures. |

Large※ | Large※ | ー | Medium to long term |

|

| Physical (4℃ scenario) |

Acute | Higher operational costs associated with suspension of operations

at stores, sales offices, and logistics centers due to the increased frequency and intensity of storms and floods. |

Large | Large | Assuming shutdown of offices and loss of all inventory. |

Short to medium term |

| Decline in business performance due to a shortage of employees

(difficulty of employees coming to work) and patients' reluctance to seek care owing to the spread of infectious diseases (pandemic). |

Small※ | Small※ | - | Medium to long term |

||

| Impact on stable supply due to inability to procure pharmaceuticals, etc.

due to suspension of supplier operations. |

Large | Large | Assuming that major suppliers will be damaged and recovery will take some time. |

Medium to long term |

||

| Chronic | Higher operational costs due to rising temperatures. | Large (About 1.6 B yen) |

Large (About 1.5 B yen) |

Calculated based on FY 2023 energy consumption and IEA parameters |

Medium to long term |

|

| Higher costs for improvement of workplace environments

and business operations due to rising temperatures |

Large | Large | Calculated based on FY 2023 energy consumption and IEA parameters |

Medium to long term |

||

| Decline in business performance due to suspension of operations

and reduction of production volume at suppliers. |

Large | Large | Assuming that major suppliers will be damaged and recovery will take some time. |

Medium to long term |

||

| Opportunity | Financial Impact(*1) | Time frames (*2) |

|

| FY2030 | FY2050 | ||

| Higher stock price and improved business performance due to higher evaluation by stakeholders as a result of taking action on climate change. |

Medium※ | Medium※ | Short to medium term |

| Business performance improves as demand for related pharmaceuticals increases due to the pandemic. |

Medium※ | Medium※ | Medium to long term |

| Increased demand for related products and services as climate change drives demand for new medical care provision system. |

Small※ | Small※ | Short to medium term |

| Creating new business opportunities as climate change drives demand for new medical care provision system. |

Medium※ | Medium※ | Short to medium to long term |

Large: 1 billion yen or more, Medium: 0.5 billion yen to less than 1 billion yen, Small: less than 0.5 billion yen

Items for which quantitative evaluation is difficult are evaluated qualitatively (※)

*2. The time frame is set at short term (to 2025), medium term (to 2030), and long term (to 2050).

3. Risk Management

Regarding risks related to climate change, the Sustainability Promotion Committee identifies risks and opportunities, evaluates them, considers and promotes countermeasures, and sets targets, and reports them to the Board of Directors periodically.

◆Process of Identifying, Assessing, and Managing Risks Related to Climate Change

The process of identifying, assessing, and managing risks related to climate change involves the following steps:

1. Risk identification

We identify climate-related risks in accordance with climate-related strategies. We identify the impacts of climate change on our business as well as the risks of natural disasters that may be caused by climate change and the risks of social and other problems. Information on climate-related risks thus identified is shared with the Risk Management Committee and the Kyoso Mirai Group Disaster Countermeasures Committee.

2. Risk assessment

We assess the potential impact of the identified risks and consider what measures to take according to their order of importance. Specifically, we consider measures to avert the risks according to their incidence and the extent of their impact. We also appraise the effectiveness of such measures and estimate the costs involved.

3. Development of climate-related measures

We design climate-related measures.

4. Target setting

Based on the risk assessment, we set targets to cope with climate risks.

5. Reporting and monitoring

The Sustainability Promotion Committee regularly reports on performance in relation to the climate targets to the Board of Directors. The Board of Directors supervises the measures to cope with the risks as well as the set targets. It also monitors progress.

6. Risk review

We continuously review climate risk management plans, the risks to be addressed in times of emergency, and the set targets according to the progress and performance in attaining the targets for the purposes of improvement.

4. Metrics and Targets

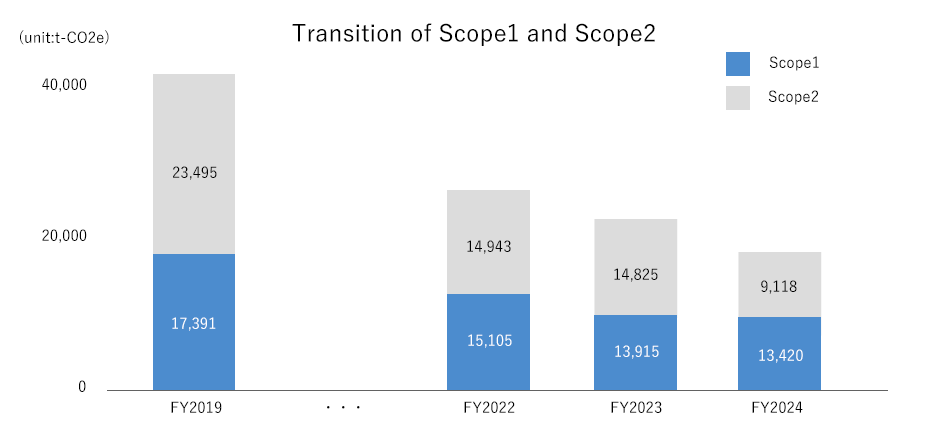

As part of its efforts to reduce its environmental footprint, the Group uses greenhouse gas emissions (Scope 1, 2, 3) as key indexes to identify the fields with large emissions and the targets for reduction. In light of changes in the social environment, we set our short-, medium-, and long-term targets for reduction as far as Scope 1 and 2 emissions, which we directly release. We are also considering specific reduction targets for Scope 3 emissions as well in the belief that efforts to reduce such emissions are also important toward the goal of carbon negative. Going forward, we will work more closely with our suppliers and customers to advance efforts to reduce greenhouse gas emissions.

Metrics |

Targets |

FY2019 |

FY2024 |

|---|---|---|---|

| Greenhouse gas emissions (Scope1・2) |

・Short-term target: 40% reduction in GHG emissions compared to 2019 ・Mid-term target: 60% reduction in GHG emissions compared to 2019 ・Long-term target: Carbon negative |

40,886t-CO2e | 22,538t-CO2e (reduced by 44.9%) |

Issue |

FY2019 |

FY2022 |

FY2023 |

FY2024 |

|---|---|---|---|---|

| Scope1 | 17,391 |

15,105 |

13,915 |

13,420 |

| Scope2 (Location-based) | 15,042 |

15,947 |

16,001 |

15,589 |

| Scope2 (Market-based) | 23,495 |

14,943 |

14,825 |

9,118 |

| Scope1 and 2 total (Scope 2 is calculated on Market-based) |

40,886 |

30,048 |

28,740 |

22,538 |

| Scope3 | 2,312,318 |

2,360,680 |

2,105,528 |

1,991,676 |

| category1(Purchased goods and services) | 2,263,257 |

2,344,474 |

2,086,402 |

1,964,191 |

| category2(Capital goods) | 40,283 |

7,494 |

10,803 |

16,041 |

| category3(Fuel and energy related activities not included in Scope 1 and 2) |

4,762 |

4,716 |

4,538 |

4,486 |

| category4(Upstream transportation and distribution) |

438 |

640 |

354 |

432 |

| category5(Waste generated in operations) | 3 |

20 |

18 |

20 |

| category6(Business travel) | 623 |

316 |

495 |

498 |

| category7(Employee commuting) | 2,952 |

2,912 |

2,771 |

5,830 |

| category13 (Downstream leased assets) | ー |

109 |

146 |

177 |

*1.Target Organization: TOHO HOLDINGS, TOHO PHARMACEUTICAL, SAYWELL, Kyushu Toho, KOYO,TOHO SYSTEMS SERVICE

*2.In the Scope3 calculation for fiscal 2024, the figures for category 2 Capital goods, 7 Employee commuting, and 13 Downstream leased assets increased due to the increase in emission intensity compared to the previous fiscal year, but there was no significant change in the actual amount of activities.

*3.Scope 2 emissions data is calculated on a market basis.

*4.In calculating the amount of greenhouse gas emissions for the current fiscal year, the emission factor for the previous fiscal year (fiscal 2023) was used because the emission factor for fiscal 2024 had not been published by some new electric power companies as of June 16, 2025. However, the emission factor for fiscal 2024 was published by the new electric power companies on July 4, and the amount of greenhouse gas emissions was recalculated.

◆Future Initiatives

The Group will deliberately work on three aspects of the energy issue to help achieve the government goal for carbon neutral . These are saving energy by retrofitting existing facilities and equipment to make them more efficient, creating energy by introducing solar power generation installations, and procuring renewable energy.

Initiatives implemented in FY2024 are as follows:

・Improvement of delivery efficiency including optimization of the number of deliveries

・Installation of own solar panels

・Introduction of EV vehicles and installation of EV charging spots

・Switching the existing electricity plan to a renewable energy plan in logistics centers